Show Me The Money

Money, by itself, has little or no value. It could be a piece of paper, a shell or a tiny piece of metal. Today, money necessarily doesn’t have a physical avatar. It’s not just a piece of electronic data, but a symbol of the leap forward in the history of human social development and man’s economic growth.

But where did it all begin ? And, where is it heading ? Is it possible to imagine a world without money as we know it ? Read on for fascinating insights into money.

Better Barter Brought Some Butter

For thousands of years, from the beginning of humankind, men exchanged goods or services in exchange for other goods or services. This system is commonly known as barter. But one difficulty with the barter system was to assign specific cost to the services and goods that were being exchanged. Interestingly, cattle became the first and oldest form of money, which in fact, brought in the notion of standard pricing.

So a man could exchange food (say in the form of cattle or fish) for cloth (such as fur) or a cow could be exchanged for two goats as cows were considered more precious than goats. Then, followed leather money (consisted of white deer skin) in China, silver coins in Ancient Lydia, the nose tax in Danes, Ireland, etc. Even in today’s economy, some communities still practice bartering. ?

Chicken Or Egg ?

According to the anthropologist, David Graeber, the notion that barter was simply replaced by money is misplaced. He rather suggests that money was invented when someone transformed the obligation “I owe you one” into “I owe you one unit of something”. Therefore, in his view, money first emerged as a means of credit and it was only later, that it evolved into an exchange medium and something with a storage value.

The Chinese Connect

The Tang Dynasty of China (7th-9th century) used paper bills for the first time. Europe was late — more than 500 years late — in catching up. But in the mid-15th century, facing a financial crisis, China stopped using paper money. So it would be many hundred years after, that China got back to using it again.

Dollar Dreams

The United States started manufacturing money from the late 18th century, starting with coins. The initial coins were of precious metal and therefore, had real value. Because of this, many Americans started hoarding the coins as a safety deposit in uncertain times.

It was during the Civil War that paper money was produced. But there was a catch. The ‘paper’ money was actually cotton.

The Eureka Moment

Inventor John Shepherd-Barron is said to have been soaking in a tub when he got the idea of a device which would later be called the automatic teller machine, more commonly known today as the ubiquitous ATM.

The first ATM was built and put up in London in 1967 by the British bank Barclays. Also, with effect of new IRS (Internal Revenue Service) rule, specially designed ATMs were placed at churches that increased tithing and credit card donations. Today, there are more than 1.6 million ATMs in the world.

Lucky 13

The number 13 is all over the dollar bill. There are 13 arrows, 13 leaves, 13 stars, and 13 stripes. Why 13 ? Because it stands for the original number of colonies that formed the United States — Pennsylvania, New Jersey, Delaware, Connecticut, Massachusetts Bay, Georgia, South Carolina, Maryland, Virginia, New York, North Carolina, New Hampshire, and Rhode Island and Providence Plantations.?

Sky-high Inflation

Between 2006 and 2010, Zimbabwe experienced mind-boggling rates of inflation. In 2006, government workers’ salaries were raised to $33 million a month, but, they still remained below the poverty line. The cost of chicken hit a million dollars; a roll of toilet paper could be bought for $145,750.

As things moved from the ludicrous to the surreal in the African nation, official inflation in October 2008 ?surged to a whopping 231,000,000%—caused by a combination of political unrest and near-economic collapse.

Royal Touch

An image of the ruling king or queen has been on coins in the United Kingdom for a millennium. But it is since 1960 that the reigning monarch has appeared on notes. Queen Elizabeth II, is the first (and so far only) monarch to have appeared on pound sterling notes.

On the opposite side of the notes of Bank of England, images of popular British people appear. Currently, Elizabeth Fry is on the opposite side of £5 notes, Charles Darwin at the back of £10 notes, Adam Smith is on £20 notes, and Matthew Boulton and James Watt at the back of £50 notes.

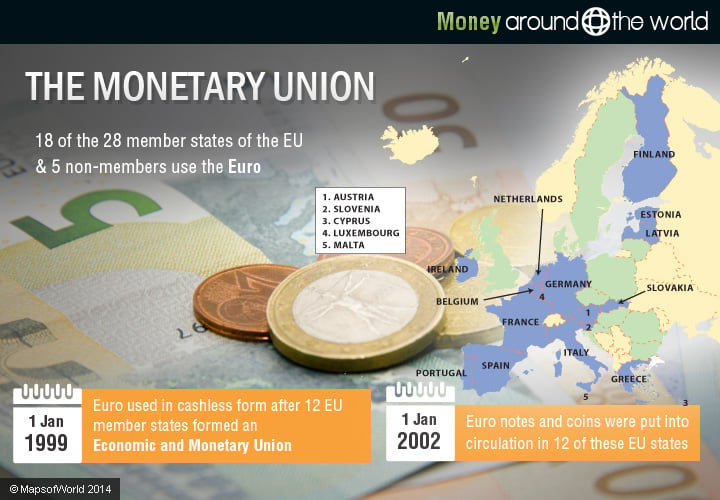

The Monetary Union – Euro

The Euro comprises bank notes in denominations of 5, 10, 20, 50, 100, 200, and 500 Euros and coins in denominations of 1 cent, 2 cents, 5 cents, 10, cents, 20 cents, 50 cents, 1 Euro, and 2 Euros.

The seven bank notes are different in both size and color. The eight coins, on the other hand, vary in size, material, color, weight, edge, and thickness.

The Euro was adopted in its cashless form on 1 January 1999 after 12 of these member states formed an Economic and Monetary Union (EMU). This helped these countries lock their currencies against the Euro. On 1 January 2002, the Euro notes and coins were put into circulation in the 12 member states. Subsequently, Slovenia, Malta, Cyprus, Slovakia, and Estonia too came aboard the Euro bandwagon.

Currently, 18 members of the 28 European Union states – Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain have the Euro ingrained into their monetary systems. The currency is also used in a further five European countries.

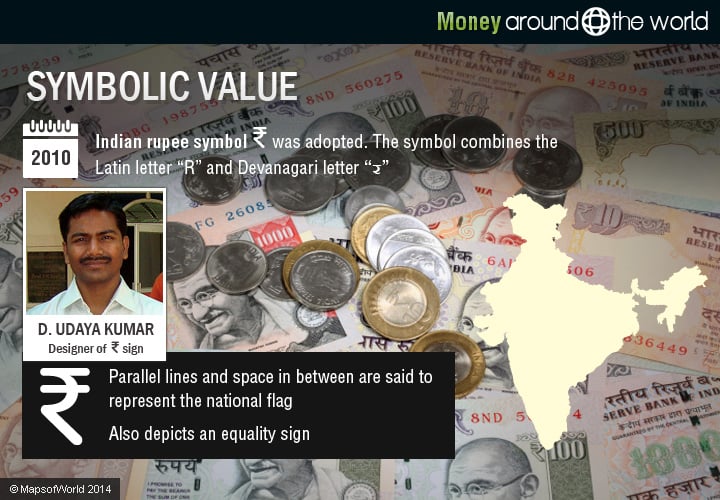

Symbolic Value

In 2010, the Indian rupee symbol ? was adopted. The symbol combines the Latin letter “R” and Devanagari letter ?. The parallel lines at the top and space in between are said to represent the national flag.

The symbol was created by D. Udaya Kumar, a student of design. Before it was adopted, the Indian rupee was commonly represented as ‘Rs’. In fact, it’s still often used as the symbol.

? Currency of Future ?

Bitcoins have been described as ‘decentralized internet currency’ with no authority regulating it. ”Coins you can send through the internet” is another definition. The catch is that the person receiving it should acknowledge its value. A Bitcoin transaction is a record of transfer of value between one public ‘Bitcoin wallet’ to another.

Bitcoins have certainly generated a lot of buzz, and while it’s hard to say whether they are the future of online transactions, the philosophy behind bitcoins — greater freedom to the individual and less regulation of financial transactions — is likely to change forever how we look at money.

Read More:

- Best Cities in the World to Launch Startups

- Where is the Chinese Economy Headed?

- India-Africa hydrocarbon summit: Strengthening ties

- $6.5 billion Cash Deal: Argentina’s Answer to Debt Battle

- Why is Norway the Best Place to Live In?

- Oil Prices and the Global Economy

- Self-made Young Entrepreneurs of the Decade

- Is the World Economy in Trouble?

- Rich People Around the World

- Money Around the World