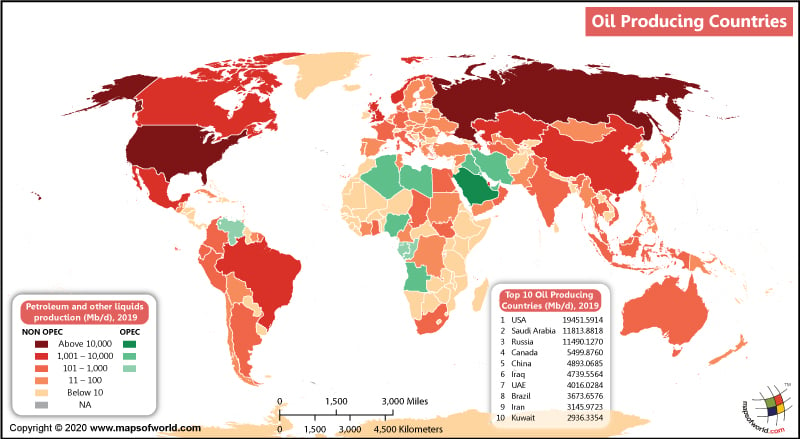

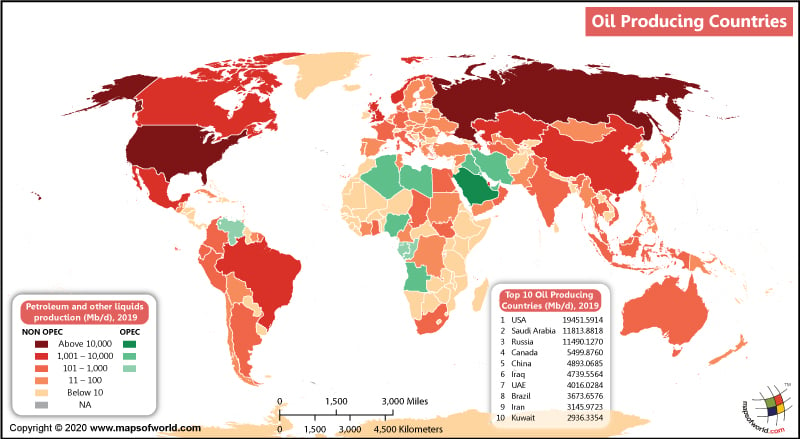

Map of world depicting oil producing countries as per the year 2019 along with the table showing top 10 oil producing countries in the world.

On April 20, 2020 (Monday), the oil price crashed to hit a new low due to excess supply, which in turn is fueled by the COVID-19 pandemic and the Russia–Saudi Arabia oil price war of 2020.

The WTI (West Texas Intermediate) crude oil futures expiring in May 2020 crashed by 321% to negative territory (to -$40.32 per barrel). This is the lowest level ever recorded. This happened because uncertainty mounted regarding the storage of excess fuel.

The WTI Crude Oil Prices reached a year and an all-time low at $11.26 in April 2020. Since then, the price has recovered a bit and is now currently trading at $29.47 per barrel (as of May 15, 2020).

A highly unusual occurrence took place during April 2020. The WTI market had entered a contango, which means that the spot prices of crude oil were lower than that of its future delivery price.

Brent crude oil price had dropped by 9.5% in April 2020 to $25.41 at intra-session lows. Brent crude oil went further down to $21.27 in April-end, the second-lowest figure in a decade. The only time, the Brent crude oil price was lower than this level back was in November 2001, when it reached $18.67.

Brent crude oil price has recovered a bit since April 2020 and is now (6.05 AM GMT, May 11, 2020) trading at $30.45. Analysts believe that by the storage capacity problem of crude oil (which in the first place triggered this crash) would go away rapidly in the second half of this year, which would help stabilize the crude oil market.

The first body blow to oil price took place when the demand for crude oil plummeted due to the freezing of activity world over due to coronavirus outbreak. With COVID-19 becoming a pandemic, governments all over the world had imposed lockdowns and movement restrictions. This caused a drastic slump in fuel use in cars and planes, leading to an excess supply of crude oil.

The OPEC and its allies agreed to the biggest-ever cut in crude oil production to backstop prices. However, the investors remained unconvinced that the production cut could offset the sudden collapse of demand for crude oil. Their fear is not unfounded because the COVID-19 pandemic is keeping societies across the globe from operating normally. This led to the panic among investors, leading to a historic fall in crude oil prices.

The West Texas Intermediate (WTI) crude oil future for May traded at large discounts. The main reason why the WTI future for May went negative is the fear that a key storage hub in Oklahoma’s Cushing (a major oil supply hub in North America that connects oil suppliers to the Gulf Coast) neared capacity. This has put forward an opportune moment for the bears in the market for mayhem.

Saudi Arabia, Iraq, Iran, Kuwait, and Venezuela in Iraq’s Baghdad. The countries that joined OPEC are Qatar, Libya, United Arab Emirates (UAE), Algeria, Nigeria, Ecuador, Gabon, Angola, and Equatorial Guinea.

OPEC was formed to increase the member countries’ influence in the global oil market, which was at that time dominated by the cartel of 7 companies (known as “Seven Sisters”), out of which 5 were headquartered in the USA. These 7 companies were controlling the crude oil prices from 1927-28 (after the Red Line Agreement of 1927 and Achnacarry Agreement of 1928).

On the fateful April 20, 2020, the demand for storing the large surplus of oil produced increased excessively. This led to the uncertainty in storing the surplus oil, making the investors fearful of future prospects.

As the major oil supply hub in North America, Oklahoma’s Cushing neared storage capacity, the investors panicked. This led to the bloodbath in the market, making the West Texas Intermediate (WTI) crude oil futures of May to go into the negative territory (-$40.32 per barrel), which is the lowest level ever recorded in the history of oil prices. In fact, this is the first time ever that the oil price has gone negative (since the New York Mercantile Exchange started trading in 1983).

Brent Crude index, the more widely used oil index, has moved downwards slowly than that of WTI. Nonetheless, it too moved downwards. The Brent Crude index contract had also fallen to a 21-year low level in April 2020, but its performance was not as bad as WTI. Almost a month has passed since that fateful crash day. Despite news of US stockpiles nearing full, the oil price has seen a slow recovery in the last one month.

The US CFTC (US Commodity Futures Trading Commission) has warned the traders that the WTI Oil index’s June contract can again go negative as it nears its expiry. In a letter, CFTC has warned the investors that the “registrants should remain vigilant and prepare accordingly” one month after the first nosedive to the negative region.

Experts say that the traders are investing cautiously this month because of the bloodbath last month. As on May 12, 2020, investors were holding contracts worth 155 million barrels of oil, a sharp dip from the 232 million barrels of oil in contracts at the equivalent time last month. However, this level is still way above the average level in the short run.

Former BP CEO John Brown has said that as the global demand for oil remains low and their storage remains at a near-full level, the risk of going negative again remains unavoidable.

Though the oil prices have increased slowly, the risks of falling remain high. This is because the chances of storage level getting back to lower levels are highly unlikely.

The surplus oil supply hasn’t gone yet despite losing a few thousand barrels this week. The market is long away from getting balanced and it will take some time to reach that level. Therefore, no one can rule out the chances for the oil price to go negative again.

Yes, there is some cautionary advice for all the investors who are in two minds about investing in oil after the oil price crash last month.

Per barrel cost of shale companies is around $50. However, the WTI oil price is hovering around $30, almost half the per barrel cost of oil production. Therefore, for each barrel of drilling, the shale companies are making losses of around $20 per barrel.

In addition, there is almost no demand in the global market as the world is going through the lockdown phase amidst the COVID-19 coronavirus crisis. The lack of global demand has maintained a consistent oversupply of oil, keeping the storage to the near-full level.

Most experts believe that the oil price will remain low for months, if not years to come. Until and unless the oil producers are able to answer how they are going to produce oil below the selling price (after factoring in overhead, taxes, and everything else), it is certain that you’ll lose money by investing in oil.

The oil stocks are also on a declining spree, thanks to the uncertain situation in the oil production market. To entice dividend investors, many companies are offering dividend yields. Some companies are paying out as much as double-digit dividends to the investors. Though some of them are worth buying, most of them may turn out to be yield trap.

Most of the oil producers are not making money because of the low oil price and are currently making a loss of around $20 per barrel. With the weak global demand for oil, the scenario is likely to continue for months, if not years. Therefore, it is likely that the sector’s payouts won’t survive this downturn.

If you are a dividend investor, you should focus more on the ability of the dividend this storm rather than the yield size.

Oil prices are at their all-time low levels. The shale companies are making a loss of around $20 for each barrel of oil production. With every barrel of oil produced and sold, the oil companies are losing money. Therefore, it is very important for oil companies to survive this onslaught.

If you invest now and hold it until the dust settles, it may rip you immense benefit. However, it is more important that the company you are betting on survives this trying time. If your speculative bet goes wrong and the company you have bet on doesn’t survive, your portfolio is going to have a gaping wound that would take a long time to heal.

So, there is no harm in waiting for the dust to settle, and the scenario gets clear who the survivors in the market are. This will at least save your portfolio from getting worse.

Related Links:

Related Maps:

The Republic of Madagascar is an island country located in the Indian Ocean, off the…

The Euro is the official currency of the European Union. It is, however, not incumbent…

There are many countries or regions that are partially recognized by the UN, have disputes…

The Alaska Statehood Act was signed into law by President Dwight D. Eisenhower in 1958,…

The name Persia may, however, only be used to refer to Iran in some contexts.…

Hawaii is an Island State in the US. It is one of the 50 states…