A tax percentage of 10.02% is charged in Louisiana on the final goods and services.

The tax levied on the sale of the final goods and services is known as sales tax. It is synonymously known as a commercial or retail tax. A sales tax is an indirect tax which is charged from the buyer at the time of purchase by the retailer who pays this amount to the government. Sales tax and the local tax is collected to maintain the facilities like roads and schools, fire department in the local state.

To calculate sales tax, the following formula is used- Purchase Power * Tax Rate.

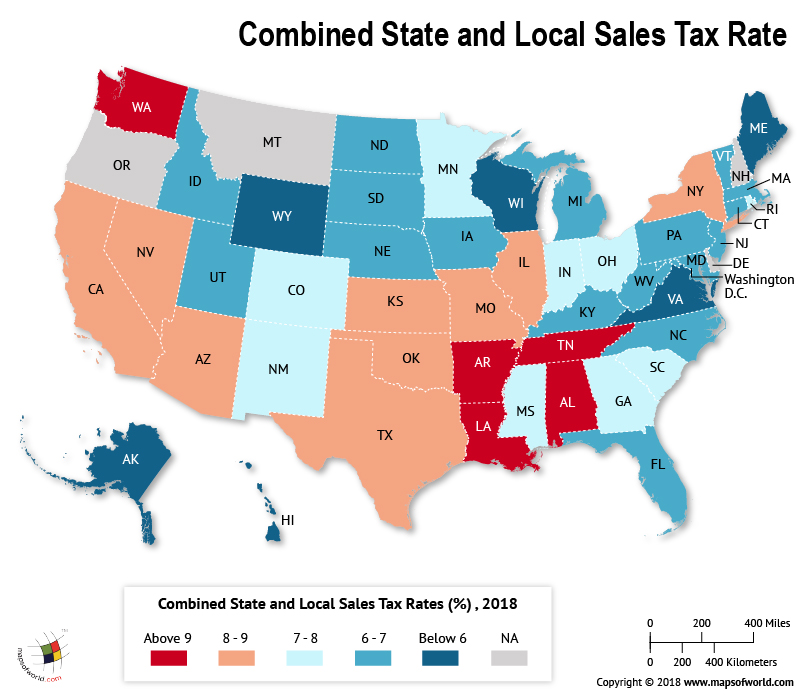

In the United States, sales tax is charged at different rates in different states. The purchasing pattern largely depends on the sales tax. It is levied on most goods and services with an exception to only a few items which vary between states. So, the buyers need to think if it makes sense to buy the goods at a higher price in their state or travel to a different state in order to buy goods at a lower price due to the difference in the tax rates.

With an exception of Arkansas, Virginia, West Virginia, and Tennessee, no other state in the US charges tax on groceries. Prescription medicines are also tax-free in most states with minimal or no tax on non-prescription medicines. Wearing apparels are tax-free in Pennsylvania while stationary items are tax-free in Kentucky.

When breaking down sales tax state-wise, Louisiana has the most tax rate, that is, 10.02% and states like Delaware, Montana, New Hampshire and Oregon charge 0% tax.

Washington based Tax Foundation is a think tank which has been providing the data about US tax policies. Here is the table representing the data as of January 1, 2018.

| Rank | State | Combined State and Local Sales Tax Rates |

| 1 | Louisiana | 10.02% |

| 2 | Tennessee | 9.46% |

| 3 | Arkansas | 9.41% |

| 4 | Washington | 9.18% |

| 5 | Alabama | 9.10% |

| 6 | Oklahoma | 8.91% |

| 7 | Illinois | 8.70% |

| 8 | Kansas | 8.68% |

| 9 | California (b) | 8.54% |

| 10 | New York | 8.49% |

| 11 | Arizona | 8.33% |

| 12 | Texas | 8.17% |

| 13 | Nevada | 8.14% |

| 14 | Missouri | 8.03% |

| 15 | New Mexico (c) | 7.66% |

| 16 | Colorado | 7.52% |

| 17 | Minnesota | 7.42% |

| 18 | South Carolina | 7.37% |

| 20 | Georgia | 7.15% |

| 19 | Ohio | 7.15% |

| 21 | Mississippi | 7.07% |

| 22 | Indiana | 7.00% |

| 22 | Rhode Island | 7.00% |

| 24 | North Carolina | 6.95% |

| 25 | Nebraska | 6.89% |

| 28 | Florida | 6.80% |

| 27 | Iowa | 6.80% |

| 26 | North Dakota | 6.80% |

| 29 | Utah (b) | 6.77% |

| 30 | New Jersey (e) | 6.60% |

| 31 | South Dakota (c) | 6.40% |

| 32 | West Virginia | 6.37% |

| 33 | Connecticut | 6.35% |

| 34 | Pennsylvania | 6.34% |

| 35 | Massachusetts | 6.25% |

| 36 | Vermont | 6.18% |

| 37 | Idaho | 6.03% |

| 38 | Kentucky | 6.00% |

| 38 | Maryland | 6.00% |

| 38 | Michigan | 6.00% |

| -41 | D.C. | 5.75% |

| 41 | Virginia (b) | 5.63% |

| 42 | Maine | 5.50% |

| 43 | Wyoming | 5.46% |

| 44 | Wisconsin | 5.42% |

| 45 | Hawaii (c) | 4.35% |

| 46 | Alaska | 1.76% |

| 47 | Delaware | 0.00% |

| 47 | Montana (d) | 0.00% |

| 47 | New Hampshire | 0.00% |

| 47 | Oregon | 0.00% |

Know more:

Related Maps:

The Republic of Madagascar is an island country located in the Indian Ocean, off the…

The Euro is the official currency of the European Union. It is, however, not incumbent…

There are many countries or regions that are partially recognized by the UN, have disputes…

The Alaska Statehood Act was signed into law by President Dwight D. Eisenhower in 1958,…

The name Persia may, however, only be used to refer to Iran in some contexts.…

Hawaii is an Island State in the US. It is one of the 50 states…