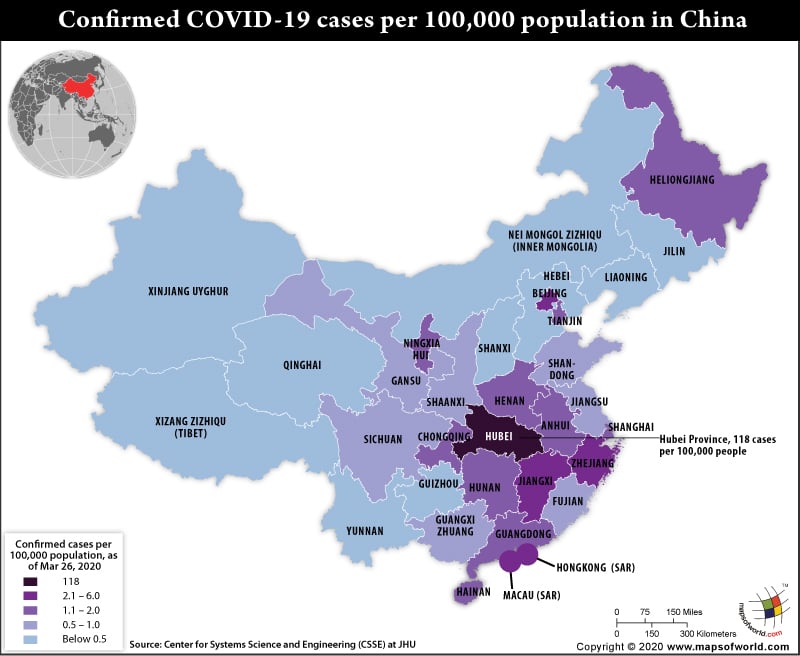

Map of China depicting coronavirus (COVID-19) cases per 100,000 population

Chinese President Xi Jinping has acknowledged on February 24, 2020, that the COVID-19 coronavirus epidemic is going to have a “considerable impact on the economy and society.” The Wuhan coronavirus outbreak is not restricted to China only. It has spilled over to around 188 countries and territories across the globe and to almost all continents (except Antarctica).

As this article is being written, the total number of novel coronavirus infection cases across the world has reached 471,518, of which 81,726 cases are in Mainland China. The global death toll due to coronavirus has reached 21,353, out of which 3,169 deaths cases are in China. World Health Organization (WHO) has called the global spread of COVID-19 “deeply concerning.”

The other countries that have been worst hit by the COVID-19 novel coronavirus are South Korea, Italy, the US, Iran, and many more. At the time of writing the article, the total number of infection cases in South Korea was 9241, followed by Italy with 74,386 infection cases, and Iran with 27,017 infection cases.

(data as per March 26, 2020)

| Country | Confirmed Cases | Deaths |

| Afghanistan | 84 | 2 |

| Akrotiri Sovereign Base Area | 0 | 0 |

| Albania | 146 | 5 |

| Algeria | 302 | 21 |

| American Samoa | 0 | 0 |

| Andorra | 188 | 1 |

| Angola | 3 | 0 |

| Anguilla | 0 | 0 |

| Antarctica | 0 | 0 |

| Antigua | 3 | 0 |

| Argentina | 502 | 8 |

| Armenia | 265 | 0 |

| Aruba | 0 | 0 |

| Ashmore and Cartier Islands | 0 | 0 |

| Australia | 2,364 | 13 |

| Austria | 5,588 | 34 |

| Azerbaijan | 93 | 2 |

| Azores | 0 | 0 |

| Bahamas | 5 | 0 |

| Bahrain | 419 | 4 |

| Bangladesh | 39 | 5 |

| Barbados | 18 | 0 |

| Barbuda | 3 | 0 |

| Belarus | 86 | 0 |

| Belgium | 4,937 | 178 |

| Belize | 2 | 0 |

| Benin | 6 | 0 |

| Bermuda | 0 | 0 |

| Bhutan | 2 | 0 |

| Bolivia | 38 | 0 |

| Bosnia and Herzegovina | 176 | 3 |

| Botswana | 0 | 0 |

| Bouvet Island | 0 | 0 |

| Brazil | 2,554 | 59 |

| British Indian Ocean Territory | 0 | 0 |

| British Virgin Islands | 0 | 0 |

| Brunei | 109 | 0 |

| Bulgaria | 242 | 3 |

| Burkina Faso | 146 | 4 |

| Burundi | 0 | 0 |

| Cambodia | 96 | 0 |

| Cameroon | 75 | 1 |

| Canada | 3,404 | 36 |

| Cape Verde | 4 | 1 |

| Cayman Islands | 0 | 0 |

| Central African Republic | 3 | 0 |

| Chad | 3 | 0 |

| Chile | 1,142 | 3 |

| Clipperton I. | 0 | 0 |

| Colombia | 470 | 4 |

| Comoros | 0 | 0 |

| Cook Islands | 0 | 0 |

| Coral Sea Islands | 0 | 0 |

| Costa Rica | 201 | 2 |

| Cote D’Ivoire | 80 | 0 |

| Croatia | 442 | 1 |

| Cuba | 57 | 1 |

| Curaþao | 0 | 0 |

| Cyprus | 132 | 3 |

| Czech Republic | 1,654 | 6 |

| Democratic Republic of the Congo | 48 | 2 |

| Denmark | 1,724 | 34 |

| Dhekelia Soverign Base Area | 0 | 0 |

| Djibouti | 11 | 0 |

| Dominica | 11 | 0 |

| Dominican Republic | 392 | 10 |

| Ecuador | 1,211 | 29 |

| Egypt | 456 | 21 |

| El Salvador | 13 | 0 |

| Equatorial Guinea | 9 | 0 |

| Eritrea | 4 | 0 |

| Estonia | 404 | 1 |

| Ethiopia | 12 | 0 |

| Falkland Islands | 0 | 0 |

| Faroe Islands | 132 | 0 |

| Federated States of Micronesia | 0 | 0 |

| Fiji | 5 | 0 |

| Finland | 880 | 3 |

| France | 25,233 | 1,331 |

| French Guiana | 28 | 0 |

| French Polynesia | 25 | 0 |

| French Southern and Antarctic Lands | 0 | 0 |

| Gabon | 6 | 1 |

| Gambia | 3 | 1 |

| Georgia | 75 | 0 |

| Germany | 37,323 | 206 |

| Ghana | 68 | 4 |

| Gibraltar | 0 | 0 |

| Greece | 821 | 22 |

| Greenland | 6 | 0 |

| Grenada | 1 | 0 |

| Guadeloupe | 73 | 1 |

| Guam | 0 | 0 |

| Guatemala | 24 | 1 |

| Guernsey | 0 | 0 |

| Guinea | 4 | 0 |

| Guinea-Bissau | 2 | 0 |

| Guyana | 5 | 1 |

| Haiti | 8 | 0 |

| Heard Island and McDonald Islands | 0 | 0 |

| Honduras | 52 | 0 |

| Hong Kong SAR, China | 410 | 4 |

| Hungary | 226 | 10 |

| Iceland | 737 | 2 |

| India | 649 | 13 |

| Indian Ocean Territories | 0 | 0 |

| Indonesia | 790 | 58 |

| Iran | 27,017 | 2,077 |

| Iraq | 346 | 0 |

| Ireland | 1564 | 5 |

| Isle of Man | 0 | 0 |

| Israel | 2369 | 5 |

| Italy | 74,386 | 7,503 |

| Jamaica | 26 | 1 |

| Japan | 1,307 | 0 |

| Jersey | 0 | 0 |

| Jordan | 172 | 0 |

| Kazakhstan | 81 | 0 |

| Kenya | 28 | 0 |

| Kiribati | 0 | 0 |

| Kosovo | 71 | 0 |

| Kuwait | 195 | 0 |

| Kyrgyzstan | 44 | 0 |

| Laos | 3 | 0 |

| Latvia | 221 | 0 |

| Lebanon | 333 | 0 |

| Lesotho | 0 | 0 |

| Liberia | 3 | 0 |

| Libya | 1 | 0 |

| Liechtenstein | 51 | 0 |

| Lithuania | 274 | 4 |

| Luxembourg | 1,333 | 8 |

| Macao SAR, China | 30 | 0 |

| Madagascar | 19 | 0 |

| Madeira | 0 | 0 |

| Mainland China | 81,286 | 3,287 |

| Malawi | 0 | 0 |

| Malaysia | 1,796 | 21 |

| Maldives | 13 | 0 |

| Mali | 2 | 0 |

| Malta | 129 | 0 |

| Marshall Islands | 0 | 0 |

| Martinique | 66 | 1 |

| Mauritania | 2 | 0 |

| Mauritius | 48 | 2 |

| Mayotte | 36 | 0 |

| Mexico | 405 | 6 |

| Moldova | 149 | 1 |

| Monaco | 31 | 0 |

| Mongolia | 10 | 0 |

| Montenegro | 53 | 1 |

| Montserrat | 0 | 0 |

| Morocco | 225 | 6 |

| Mozambique | 5 | 0 |

| Myanmar | 0 | 0 |

| Namibia | 7 | 0 |

| Nauru | 0 | 0 |

| Nepal | 3 | 0 |

| Netherlands | 6,440 | 356 |

| New Caledonia | 14 | 0 |

| New Zealand | 283 | 0 |

| Nicaragua | 2 | 0 |

| Niger | 7 | 1 |

| Nigeria | 51 | 1 |

| Norfolk Island | 0 | 0 |

| North Korea | 0 | 0 |

| North Macedonia | 177 | 3 |

| Northern Mariana Islands | 0 | 0 |

| Norway | 3,084 | 14 |

| Oman | 99 | 0 |

| Pakistan | 1,063 | 8 |

| Palau | 0 | 0 |

| Palestine | 71 | 0 |

| Panama | 558 | 8 |

| Papua New Guinea | 1 | 0 |

| Paraguay | 37 | 3 |

| Peru | 480 | 9 |

| Philippines | 636 | 38 |

| Pitcairn Islands | 0 | 0 |

| Poland | 1,051 | 14 |

| Portugal | 2,995 | 43 |

| Puerto Rico | 0 | 0 |

| Qatar | 537 | 0 |

| Republic of the Congo | 4 | 0 |

| Reunion | 111 | 0 |

| Romania | 906 | 17 |

| Russia | 658 | 3 |

| Rwanda | 41 | 0 |

| Saint Helena | 0 | 0 |

| Saint Kitts and Nevis | 2 | 0 |

| Saint Lucia | 3 | 0 |

| Saint Martin | 11 | 0 |

| Saint Pierre and Miquelon | 0 | 0 |

| Saint Vincent and the Grenadines | 1 | 0 |

| Samoa | 0 | 0 |

| San Marino | 208 | 21 |

| Sao Tome and Principe | 0 | 0 |

| Saudi Arabia | 900 | 2 |

| Senegal | 99 | 0 |

| Serbia | 303 | 6 |

| Seychelles | 7 | 0 |

| Sierra Leone | 0 | 0 |

| Singapore | 631 | 2 |

| Sint Maarten | 0 | 0 |

| Slovakia | 216 | 0 |

| Slovenia | 528 | 5 |

| Solomon Islands | 0 | 0 |

| Somalia | 1 | 0 |

| South Africa | 709 | 0 |

| South Georgia and the Islands | 0 | 0 |

| South Korea | 9,137 | 131 |

| South Sudan | 0 | 0 |

| Spain | 49,515 | 3,647 |

| Special Municipalities (Neth.) | 0 | 0 |

| Sri Lanka | 102 | 0 |

| St. Barthelemy | 3 | 0 |

| Sudan | 3 | 1 |

| Suriname | 8 | 0 |

| Swaziland | 4 | 0 |

| Sweden | 2,526 | 62 |

| Switzerland | 10,897 | 153 |

| Syria | 5 | 0 |

| Taiwan | 235 | 2 |

| Tajikistan | 0 | 0 |

| Tanzania | 13 | 0 |

| Thailand | 934 | 4 |

| Timor-Leste | 1 | 0 |

| Togo | 23 | 0 |

| Tokelau | 0 | 0 |

| Tonga | 0 | 0 |

| Trinidad and Tobago | 60 | 1 |

| Tunisia | 173 | 5 |

| Turkey | 2,433 | 59 |

| Turkmenistan | 0 | 0 |

| Turks and Caicos Islands | 0 | 0 |

| Tuvalu | ,0 | 0 |

| Uganda | 14 | 0 |

| Ukraine | 145 | 5 |

| United Arab Emirates | 333 | 2 |

| United Kingdom | 9,640 | 465 |

| United States of America | 69,018 | 1,032 |

| United States Virgin Islands | 0 | 0 |

| Uruguay | 217 | 0 |

| US Minor Outlying Islands | 0 | 0 |

| US Naval Base Guantanamo Bay | 0 | 0 |

| Uzbekistan | 60 | 0 |

| Vanuatu | 0 | 0 |

| Vatican (Holy Sea) | 4 | 0 |

| Venezuela | 106 | 0 |

| Vietnam | 148 | 0 |

| Wallis and Futuna | 0 | 0 |

| Western Sahara | 0 | 0 |

| Yemen | 0 | 0 |

| Zambia | 12 | 0 |

| Zimbabwe | 3 | 1 |

Some other worst affected countries from this mild pandemic include Germany, France, Spain, Japan, the USA, Switzerland, United Kingdom, Netherlands, Sweden, and Belgium. More than 200 confirmed cases of infection have been reported from these countries.

The global spread of COVID-19 has adversely affected some of the leading companies, such as Apple, Microsoft, and Nissan. China was under a partial lockdown, especially in industrially advanced zones, including Hubei province.

The spread of Wuhan coronavirus to around 188 other countries, including South Korea, Italy, and Iran, is accentuating the crisis. As South Korea and Italy are other major economies in the supply chain suffering from coronavirus outbreak, the pandemic is steadily transforming to an economic pandemic.

IMF’s managing director Kristalina Georgieva said that the effect of coronavirus on 2020 global growth would be -0.1% than expected. However, she cautioned that the economic slowdown might assume a more dire scenario if it gets “more persistent and widespread.”

With panic hitting the global markets due to the looming threat of COVID-19 outbreak across the world and oil price slump, stock markets around the globe are witnessing a bloodbath.

China forms the second biggest block of the global economic chain of markets. A large part of China, especially the Hubei province and other industrially advanced provinces, was under massive lockdown for containing the coronavirus epidemic.

Wuhan, the capital of Hubei province and the epicenter of COVID-19 novel coronavirus, is the transport hub of China, and that’s why the city is known as the “thoroughfare of China.” Its indefinite lockdown halted all transports, affecting the Chinese economy to a great extent.

Estimates say that the Chinese economy is going to slow down to 4.5% in the 2020 first quarter, and the global economy will slow down by 0.1% in 2020. The COVID-19 coronavirus outbreak was already felt by the leading stock exchanges in China before its closing for the Lunar New Year break. The composite stock market indices of Shenzhen and Shanghai stock exchanges fell by 3.52% and 2.75%, respectively.

As China forms the 2nd biggest block of the global economic chain, the effect on the Chinese economy due to COVID-19 is being felt on a worldwide scale. The full impact of the Wuhan coronavirus crisis in China and across the world will not be fully known until the spread of the virus is contained completely, and businesses in China and the world over start functioning normally.

Asian Development Bank had estimated that the 2002-03 SARS outbreak had led to a loss of $18 billion. In the case of COVID-19 coronavirus, the human and economic effects are going to be huge and more significant than the SARS outbreak. With the world population locked down due to the coronavirus outbreak, the conservative estimates say that the growth rate of China may slow down by 0.5% to 1%, which will lead to an economic loss of around $100-150 billion in China.

A Bloomberg Economics report has said that the Chinese economy is running at just 40-50% of the total capacity as the second-largest economy of the world remains out of action because of the shutting down of businesses due to coronavirus epidemic.

The supply chain in China was adversely affected from all sides after the outbreak. The novel coronavirus has adversely affected the global oil demand too. This outbreak led to continued factory shutdown in China, thereby slowing down the supply of products and parts from China.

The human movement in China had fallen significantly due to the coronavirus outbreak. Millions of people couldn’t travel back to work even after their scheduled Lunar New Year 2020 holiday has been over. The long-distance buses were plying at a 50% capacity for reducing the risk of COVID-19 infection transmission. This backlog will take a long time to clear.

The sector that has been worst hit by the outbreak of COVID-19 novel coronavirus is the consumption. The buying pattern of Chinese consumers has changed significantly since the outbreak intensified in January. They are pulling back on their discretionary spending, especially restaurant and travel expenditures.

If you look at the revenue earned by the box office during this Lunar New Year, you can have an idea of how Chinese consumers have curtailed their discretionary expenditure.

The spending habits of the consumers will not get back to normal till coronavirus is contained in totality, people get back to work and get paid, and ultimately reach their confidence to spend again.

Director of macroeconomic analysis at CEBM Group, Zhengsheng Zhong, has said: “Stagnating consumption amid the coronavirus epidemic has had a great impact on the service sector.”

The Caixin/Markit services purchasing managers index (PMI) dropped from 51.8 in January 2020 to just 26.5 in February 2020.

With tens of millions of people forced to stay at home with strict travel restrictions, business activity fell sharply since late January 2020. Many restaurants, malls, and theater halls remained closed even after many provinces lifted the curbs.

The demand scenario of the service sector was at its all-time low not only from the domestic front but also from overseas. Export demand dropped the most since the sub-index was introduced in September 2014. The employment sub-index also hit its lowest level for the first time in almost a year and a half. The services companies have been forced to shed jobs due to the dull demand, triggered by the coronavirus crisis in China and abroad. Due to the travel restrictions, many firms also struggled to recruit staff, worsening the job scenario in the services sector and even the tertiary sector as a whole.

A survey conducted on more than 20,000 companies (mostly services firms) by a China Merchants Bank in February showed that around 6% of them are on the brink of collapse, and another 20% of the companies are facing severe difficulties.

China’s industrial capacity remains idle. The electricity demand remains weak even after the medical equipment makers and large state-owned industrial firms have ramped up their output.

Reports say that the industrial sector in China as a whole has slowed down by around 25-50%. The industries that experienced maximum slowdown are steel production, coal-fired power generation, and oil refining.

The slowdown in the industrial sector is also evident from the fact that the extent of nitrogen dioxide emission in the week after the Lunar New Year 2020 holiday was around 36% below than the level a year back (during Lunar New Year 2019 holiday), as per the Centre for Research on Energy and Clean Air.

The composite manufacturing and services PMI of Caixin has slowed down from 51.9 in January 2020 to 27.5 in February 2020. However, the industry that was worst affected by the epidemic is the services sector, and it will likely be more difficult for service companies to make up their cash flow losses.

Monthly PMI data indicate the economic health of a country as it is calculated by considering data of the private sector companies. That’s why this data has a profound effect on the psyche of the investors in the financial markets and, therefore, also decides on the direction and movement of the economic market.

China is the manufacturing hub of the world (making up 1/3rd of the total global manufacturing) as well as the largest exporter in the world. Therefore, any slowdown in the manufacturing and export potential of China will have a profound effect on other countries. To contain the spread of COVID-19 coronavirus, China has put into effect significant restrictions in many provinces. As China is the so-called “factory of the world,” and the Chinese consumer market is one of the biggest demand generators for many multinational companies, it has adversely impacted the sales and bottom-lines of many behemoths such as Apple, Volkswagen, Jaguar Land Rover, and Diageo.

Available data suggest that the factories in China are struggling to find enough workers, even after one month of the Lunar New Year holiday. Bloomberg Economics report says that the factories in China are currently running at a capacity of around 60-70%.

There are around 300 million migrant workers in China. However, due to quarantine rules and widespread fear about the deadly coronavirus, approximately 1/3rd of the migrant workers haven’t reported back to their work. If the situation continues, the impact would far exceed that of the financial crisis during 2007-2008.

The question that looms large is how fast the factories in China will return to normalcy so that the world doesn’t get into yet another deep recession.

One of the worst effects of the COVID-19 coronavirus epidemic in China is in the technology sector. As China is an important part of the global supply chain, many experts are warning customers of the shortfall of a wide range of technology products, including smartphones, Virtual-reality headsets, advanced cars, and many other technology accessories.

Two essential gadgets companies such as Foxconn and Pegatron have been facing the closure of factories in China as all the factory workers haven’t been able to resume their works due to coronavirus fear as well as quarantine rules (in many places). That’s why there is a potential delay in the estimated production and subsequent delivery of iPhones and AirPods.

The Foxconn factories in Zhengzhou and Shenzhen have partially resumed their production. Even after one month to the Lunar New Year holiday, many workers haven’t reported back to their work either because of the restrictions imposed by the Chinese government or due to the looming fear of coronavirus infection.

Facebook is not yet taking new orders of its latest Virtual Reality (VR) headset – Oculus Quest. They have said in an official statement that the COVID-19 coronavirus epidemic in China has adversely impacted the hardware production of their latest Oculus Quest VR headset.

Another leading tech company Asus has told its gaming consumers that the niche gaming ROG Phone IIII’s availability will be delayed until further notice because of the coronavirus outbreak. Other Chinese MNCs such as Lenovo, Xiaomi, Oppo, and Huawei are also facing production crunch and are running behind their delivery schedule. Huawei is less severely affected because its factory is located in Guangdong, where the level of production has reached 100% capacity. As Lenovo relies on the components supplied from Hubei province (which houses Wuhan city, the epicenter of COVID-19 pandemic), it will take a long time for the company to reach its full production capacity.

Tesla is yet another company that has postponed delivery of their Model 3 because of the factory closures due to coronavirus. The delay in the Shanghai factory’s production has delayed the delivery of Model 3 cars.

The adverse impact on iPhone production, coupled with a reduction in retail traffic, is likely to impact the revenue of Apple, the company said.

China wants to become an international aviation hub. However, this aim is getting a severe beating after the COVID-19 novel coronavirus outbreak has become a pandemic. Data from OAG Aviation Worldwide showed that China’s overall air traffic fell to a distressingly low level during January 20 and February 17. During this period, China’s global market share of total air traffic dropped to 25th.

In recent weeks, the situation has bounced back, and the global market share of China in overall air traffic has become second. This has become possible mainly because of two reasons:

A blog (published on March 2) on OAG Aviation Worldwide website says: “O “the 2.9 million scheduled seats returning to the Chinese market, all but 3,000 are on domestic services.”

It also said,” Special offers are being doled out by the airlines to woo back the customers. A division of the state-owned Air China is Shenzhen Airlines. It is offering economy flight tickets at just 5% of the standard price. Usually, an economy class ticket for flying 1,000 km (621-mile) journey from Shenzhen to Chongqing will cost around 1,940 yuan (US$276). However, Shenzhen Airlines is charging just 100 yuan (US$14) for that ticket.

To boost the aviation industry further, the Civil Aviation Administration of China (CAAC) has announced that it would pay both the domestic and international airlines to restore their services. China will reportedly provide the airliners:

With the World Health Organization (WHO) announcing the global outbreak of COVID-19 coronavirus as a “public health emergency of international concern” and a pandemic, it has triggered a further drop in airline traffic. The fast spread of the coronavirus in South Korea, Italy, and Iran will likely restrict international air travel further for a long time.

Estimates as per research firm Civil Aviation Data Analysis says that the Chinese aviation industry could lose at least 72 billion yuan in February and March 2020 alone due to weak demand among travelers as well as flight cancellations.

International Air Transport Association (IATA) estimates that in 2020, airlines in the Asia-Pacific region would make a loss of US$27.8 billion in revenues and US$12.8 billion in revenues in the Chinese domestic market because of the coronavirus outbreak.

As coronavirus tore through the 2nd largest economy of the world, both exports and imports plummeted in China.

The data released by the General Administration of Customs show that during January-February 2020, Chinese exports fell by -17.2% in comparison to the same period in 2019. However, the exports grew at a rate of 7.9% in December 2019, just before the COVID-19 outbreak started. The export sector performed worst in August 2009 at -22.2% as the world was struggling from the 2007-08 US financial crisis. As China accounts for around 15% of the global exports, the halting of export growth in China will have a significant effect globally.

During January-February, imports also dropped by -4% concerning the same period in 2019. In December 2019, the import grew by 16.5%. The historically worst performance of the import sector was in January 2009 when it dipped by -43.1%.

The foreign trade in China during Jan-Feb’ 20 is US$591.99 billion, which is down by -11% in comparison to the same period last year.

Economist Larry Hu warned that “the worst is yet to come for exports and supply chains” in China due to the COVID-19 coronavirus pandemic. Investment bank Nomura has said in a note that the latest data doesn’t fully show the devastating impact of the COVID-19 coronavirus.

Nomura also said in the note that the export growth is expected to further slow down to around -20% in March 2020 in comparison to that of March 2019. This will be large because of the sharp drop in the imports of processing and assembly. The note also says that due to the slow recovery of domestic demand and slumping price of crude oil, the growth of imports will sharply fall to 18% in March 2020 in comparison to that of March 2019.

Euler Hermes Insurance Company estimates that China is going to lose U$108 billion in the exports of goods, US$72 billion in travel, and US$10 billion in transport services, which will lead to a total export loss of US$190 billion.

In China, trade deficits are rare. Most of the time, China maintains a substantial trade surplus. Large trade surplus provides the Chinese economy the coveted financial stability and also makes it competitive in merchandise trade. However, the COVID-19 coronavirus outbreak has turned the smooth running of the Chinese economy topsy-turvy.

A Reuters poll of economists has predicted that the Wuhan coronavirus outbreak is likely to drag down the growth rate of China to 4.5% in Q1 2020. The outbreak is expected to have a far worse effect than that of the 2002-03 SARS outbreak, which led to a loss of US$18 billion. During the SARS outbreak, the GDP growth rate of China dipped by around 1.1-2.6%.

Some earlier estimates have predicted that due to the recent coronavirus outbreak, the economic growth of China may slow down by 0.5-1%. If the slowdown is around 1%, China’s financial loss will be more than $136 billion.

IMF managing director Kristalina Georgieva has said during a press conference in Washington (on March 4, 2020) that they have revised their 2020 growth outlook for China from 6% (January estimate) to 5.6% due to the global spread of the COVID-19 epidemic.

To contain the mounting loss and economic slowdown, the Chinese President Xi Jinping has asked the officials at the county-level, through a rare televised conference, to restore production wherever possible. He has said that around 46% of China’s total area (comprising of as many as 1,396 counties and districts) has not been affected by the 2019-nCov coronavirus. Not a single infection case has been reported in these areas.

Xi has asked officials in the low-risk zones to restore production comprehensively. He also urged the medium-risk regions to start production in an orderly manner. The Chinese President has assured that the effect from the coronavirus epidemic will be “short term and generally under control.”

The note, while reviewing the entire situation in China, said that the COVID-19 novel coronavirus epidemic has hit its worst peak and has already started to plateau in the epicenter Wuhan in Hubei province.

Temporary closure of the stores in China and a massive decline in consumer spending will take another 2-months time to reach normalcy. Therefore, the businesses will take another two months to reach the position of a turnaround.

Companies such as Yum! China (which owns KFC) and other discretionary businesses and restaurants will experience a gradual recovery only in May 2020.

Related Links:

The Republic of Madagascar is an island country located in the Indian Ocean, off the…

The Euro is the official currency of the European Union. It is, however, not incumbent…

There are many countries or regions that are partially recognized by the UN, have disputes…

The Alaska Statehood Act was signed into law by President Dwight D. Eisenhower in 1958,…

The name Persia may, however, only be used to refer to Iran in some contexts.…

Hawaii is an Island State in the US. It is one of the 50 states…