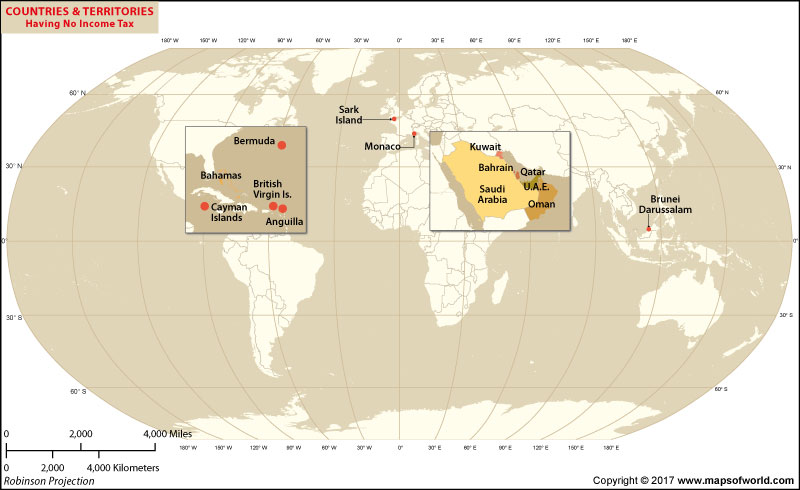

There are about fourteen countries that have no income tax

Income tax is defined as the tax that a government imposes on the financial income of individuals or entities within its jurisdiction. In most countries all individuals (adults) and businesses are required to file income tax returns every financial year. These returns determine if the individual or the business owes the government any income tax. The money collected from the various taxes imposed by the government (including income tax) goes into the public exchequer and is spent on the development of the country. While most countries of the world impose income tax, there are a few that do not. Here’s a list of the countries where any individual need not pay income tax (according to the KPMG Global Tax Rate Survey, 2015) –

• Anguilla

• Bahamas

• Bahrain

• Bermuda

• Brunei Darussalam

• Cayman Islands

• Kuwait

• Oman

• Qatar

• United Arab Emirates

It is important to note here that despite being one of the most comprehensive worldwide tax surveys undertaken, the KPMG report does not include individual income tax rates for countries like Afghanistan, Bolivia, Cambodia, Cameroon, Democratic Republic of Congo, Ecuador, Ghana, Gibraltar, Iraq, Italy, Lebanon, Libya, Liechtenstein, Macedonia, Mauritius, Mozambique, Pakistan, Panama, Paraguay, Samoa, Saudi Arabia, Sierra Leone, Sudan, Syria, Tanzania, and Vanuatu.

Of these countries not mentioned in the survey, Saudi Arabia does not impose any individual income tax. The rest of the countries do impose income tax at varying levels. The Principality of Monaco is a microstate in the French Rivera that does not impose individual income tax. There are also a number of dependencies, territories that do not impose tax on individual income. These include the Island of Sark and the British Virgin Islands.

Now while we enumerate these countries with no income tax, it is important to remember that most of these countries do impose other forms of taxes on the individuals and corporations within their jurisdiction. Corporate Taxes, Indirect Taxes, and Social Security Taxes are still revenue earners for the governments of these countries. Some of them also exempt tax on domestic income while taxing income from foreign sources.

Related Maps:

The Republic of Madagascar is an island country located in the Indian Ocean, off the…

The Euro is the official currency of the European Union. It is, however, not incumbent…

There are many countries or regions that are partially recognized by the UN, have disputes…

The Alaska Statehood Act was signed into law by President Dwight D. Eisenhower in 1958,…

The name Persia may, however, only be used to refer to Iran in some contexts.…

Hawaii is an Island State in the US. It is one of the 50 states…