A diversified financial services company, Wells Fargo and Co. is the world's second-largest bank by 'market capitalization' and United States, third-largest by 'total assets'.

A diversified financial services company, Wells Fargo and Co. is the world’s second-largest bank by ‘market capitalization’ and is the third-largest by ‘total assets‘ in the United States. Working true to their principles of availing the customers with best financial services by building a trust relationship, the company provides guidance and a full range of financial needs. The 160 years old company, is rich in details with America’s history, evolving at each phase to serve the needs of the West. Through prosperity, depression and war crisis to the Gold Rush and early 20th century, the company earned a reputation of great trust and loyalty from its service seekers.

The two founders of ‘American Express,’ Henry Wells and William Fargo, co-founded Wells Fargo, in 1852, offering banking services including buying gold and selling paper bank drafts as good as gold and express services like rapid delivery of gold and anything else of similar value.

The company gained a reputation in the 1850s, as the economy went through a boon and burst and everlasting fame in the 1860s, receiving its corporate symbol. The use of stagecoach, steamship, railroad, pony-rides or telegraph were used to render the fastest business possible. It also adopted the motto of ‘ocean-to-ocean’ to reflect the vast connected 2,500 communities in 25 states and ‘over-the-seas‘ linking of America’s global economy.

The ‘Wells Fargo & Co.’s Bank,’ formally split from ‘Wells Fargo and Co. Express’ in 1905, which thrusted the bank’s pace of development and helped in rebuilding its banking business across the West. But the bank weathered through the Great Depression with the aid of sound management, serving the nation through World War II, and meet with the customers needs in the post-war era.

Expanding to as a ‘banker’s bank’ in 1923, Wells Fargo spread to the entire West. The 1960s saw the bank prosper to a Northern California regional bank and had stores everywhere people lived and played. The 1980s witnessed the bank turn into a state-wide bank and further becoming the seventh largest bank in the nation. By the 1990s, the bank had returned to its historical stance on the territory through Western, Midwestern and Eastern states.

The Wells Fargo of the 21st century headquartered at San Francisco, is a product of more than 1,500 mergers over a time period of 160 years. The acquiring of the company by ‘Norwest Corporation’ in 1998, accepting the former’s name, reconnected their heritage-in-common of William G. Fargo, founder of both the institutions. Norwest, was ranked highly for its customer satisfaction and was admired largely. Whereas the 2008 merger with Wachovia, fostered the company in accepting and transforming new banking concepts of drive-up tellers, banking by phone, express lines, credit cards, automated teller machines and online banking. This extended once again the company’s motto of ‘ocean-to-ocean’ and ‘over-the-Seas.’ The mobile banking services offered by the company, was the fastest growing ‘on the go’ banking tool- growing twice as fast as online banking.

The business in the contemporary times, delineates into three different segments: Community banking, Wholesale banking and Wealth, brokerage and Retirement.

The company in addition operates 12 museums, most known as ‘Wells Fargo History Museum’ in its corporate buildings. The displays include original stagecoaches, photographs, gold nuggets and mining artefacts, the pony express, telegraph equipment and historic bank artefacts. It also operates the Alaska Heritage Museum which displays about Wells Fargo history in the Alaskan Gold Rush era.

Aiming to become the global leader of financial services, they frame their policies as consumer-centric, and endow the ethics of highest standards of integrity, transparency, and principled performance. The work reflects inclusiveness and promotes diversity in all aspects of business at all levels. Encouraging innovative thinking and setting the global standards in managing all forms of risks, the need to protect customers assets, information and privacy is given utmost importance.

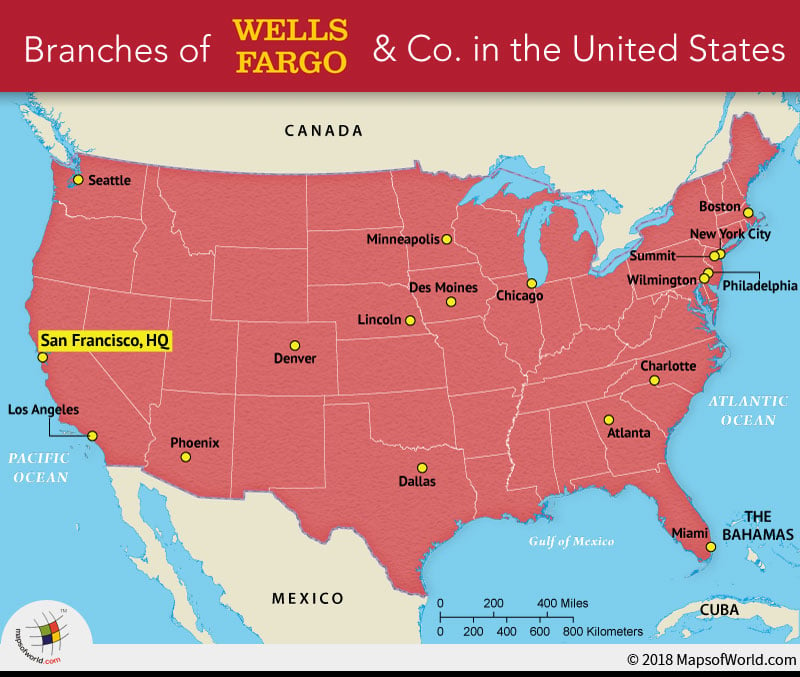

Below lying table mentions the head branches of Wells Fargo and Co. in United States:

| State | City |

|---|---|

| Washington | Seattle |

| California | San Francisco |

| California | Los Angeles |

| Arizona | Phoenix |

| Colorado | Denver |

| Texas | Dallas |

| Oregon | Lincoln |

| Minnesota | Minneapolis |

| Iowa | Des Moines |

| Illinois | Chicago |

| Georgia | Atlanta |

| Florida | Miami |

| North Carolina | Charlotte |

| Delaware | Wilmington |

| Pennsylvania | Philadelphia |

| Michigan | Summit |

| New York | New York city |

| Massachusetts | Boston |

Know more:

Related maps:

The Republic of Madagascar is an island country located in the Indian Ocean, off the…

The Euro is the official currency of the European Union. It is, however, not incumbent…

There are many countries or regions that are partially recognized by the UN, have disputes…

The Alaska Statehood Act was signed into law by President Dwight D. Eisenhower in 1958,…

The name Persia may, however, only be used to refer to Iran in some contexts.…

Hawaii is an Island State in the US. It is one of the 50 states…